XRP consolidates after a significant increase. Find our complete analysis and current technical perspectives.

In short

- The XRP technical analysis consolidates around $ 2.14 after a sharp increase. The trend remains neutral on mobile diameters, with a slim and weekly decrease of -4.33 %, which is a sign of dynamics loss.

- Key levels: The main resistance is $ 2.36, $ 2.6 and $ 3, while key support is $ 2, $ 1.9 and $ 1.7-1.6. The swivel point to $ 2.05 remains central to the trend of the month.

- Derivative analysis: open interest is stable, with sales dominance to CVD. Little disposal on the long side and neutral financing sparse translates the wait -see market under pressure sales.

- Forecasts: Over $ 2 is possible to return to $ 2.6. In the event of a break, the targets to 1.7 and $ 1.6 are possible. The potential is between +42 % and -32 %.

- Macro Context: Further economic decisions, especially FOMC, could consider the XRP trajectory and cause the trend to reverse the trend.

Technical analysis XRP

| Indicator | State | Comment |

| Spot price | ≈ 2,14 $ | The XRP is stabilized and evolved in the consolidation phase after the previous increase. |

| The latest weekly variations | – 4.33 % | XRP means a decline and contrasts with a 7 % increase recorded in the previous week. |

| The latest weekly volumes | ≈ 4.2 billion (-33%) | Activity on the point market shows a bright breath, reflecting the renewed wait -a -see investors. |

| Trend with a long term (SMA 200) | Neutral | Neutral structure, very slightly upward supporting positive long -term distortion. |

| Middle Trend (SMA 50) | Neutral | Slightly neutral orientation, reflecting the lack of beliefs in the medium term. |

| Short -term trend (SMA 20) | Neutral | The trend is stabilized and signals the loss of short -term dynamics. |

| Mobility | Fold | Momentum with folds after the oscillator. |

The XRP is stabilized around $ 2.14 and develops in the consolidation phase after a high front increase. During the week, the cryptocurrency dropped by 4.33 %, reversing the positive dynamics of +7 % recorded last week. This withdrawal is accompanied by a significant decrease in the volume volume of points, a decrease in 33 %, reflecting pure shortness of activity and renewed waiting -a -and -aid operators. From a technical point of view, trends with a long and middle period remain neutral with slightly biased distortion, in the short term, the dynamics stabilizes and signals speed loss. On the other hand, this momentum is in withdrawal and technical indicators are aimed at developing bear pressure.

Technical levels XRP

| Indicator | State | Comment |

| Resistance | 2.36 $ $ / 2.6 $ / $ 3 | Critical areas, potential Prague distribution. |

| Support | $ 2 / 1.9 $ / 1.7 $ – 1.6 $ | Main levels of defense, probable accumulation zone. |

| The last daily break | 1.9 $ | December support; Strengthening lower distortion. |

| Monthly beer | 2.05 $ | Reference level for the trend of the month under the course. |

| High -value area | 2.4 $ | High volume area; The upper terminal of the market balance, which may occur imbalance. |

| Low -value area | 0.6 $ | High volume area; Low limit of market balance, which may occur imbalance. |

XRP is currently developing over its lunar swivel point ($ 2.05), which supports short -term bias despite recent support of $ 1.9. Resistors to $ 2.36, $ 2.6 and $ 3 Mark Potential Distribution Area. Key technical support is a reduction, level 2, $ 1.9 and $ 1.7 $ 1.6. The area with a high value ($ 2.4) is a critical threshold: the break could start a bull imbalance. The low value area ($ 0.6) remains an extreme level that will only be monitored in the case of a large break.

The current technical analysis was carried out in cooperation with ElyfeAND 0xhugzerInvestors and popularizers on the cryptocurrency market.

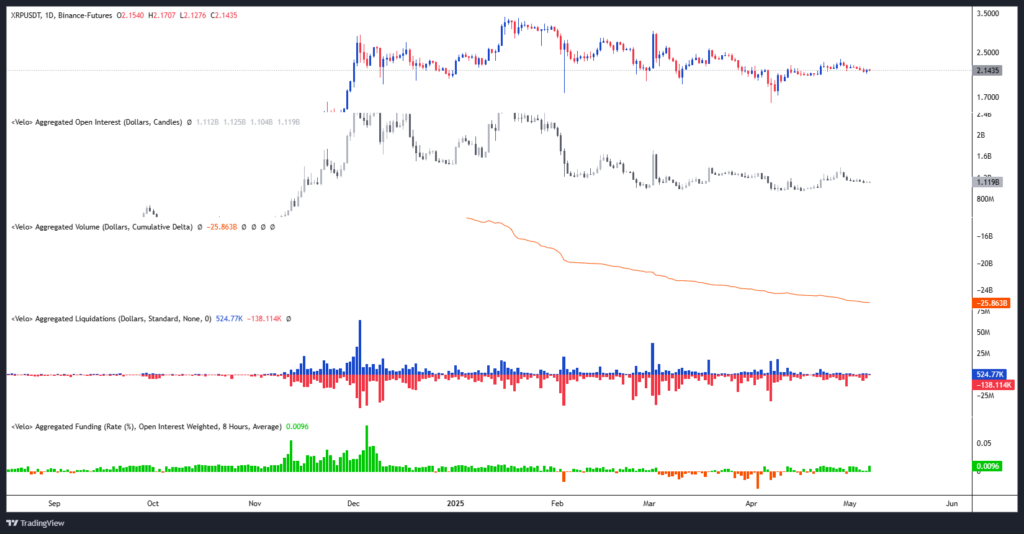

Derivative analysis (XRP/USDT)

| Indicator | State | Comment |

| Open interest | Stable | Stability of the exhibition, the absence of a clear signal on speculative connection. |

| CVD | Dealer’s dominance | CVD downwards, down, price: sales pressure on the dominant market. |

| Disposal | Weak, long side | Slight excess of long disposal, measured sales pressure. |

| Financing rate | neutral | Stable funding: absence of imbalances between buyers and sellers. |

The open interest remains stable, which reflects the unchanged exposure and the absence of strong speculative beliefs. CVD shows sales dominance with net pressure on market sales. The liquidation remains low, especially on the long side, which indicates a slight sales pressure without excess lever effect. Finally, the financing rate is neutral, a sign of a temporary balance between buyers and sellers. The whole attracts a quiet technical environment, but under the control of the seller.

| Indicator | State | Comment |

| Sale of liquidation zone | ≈ 2,17- 2,28 / 2,37- 2.44 $ / 2.5- 2.7 $ | Order concentration; Achieving these levels could lead to the acceleration of volatility. |

| Buyer liquidation area | ≈ 2.07 $ – 1.97 $ / 1.70 $ / 1.62 $ | Order concentration; Achieving these levels could lead to the acceleration of volatility. |

Several sales zones are identified between $ 2.17-2.28, $ 2.37-2.44 and $ 2.5-2.5, which means that in the event of a transition they are likely to generate up up. Conversely, shopping liquidation zones located between $ 2.07-97, then $ 1.70 and $ 1,62 represents fragility for long positions, which can amplify the pressure down if they are activated. These levels represent potential areas of volatility that need to be carefully monitored.

Forecasts for the XRP course

Haussier Screenplay:

- Conditions: Maintenance over $ 2.

- Objectives: 2,36 $ / 2.6 $ / 3 $ and more.

- Potential: approximately +42 % from the current level.

Lower scenario:

- Terms and Conditions: Survey of Support for $ 2.

- Objectives: 1.9 $ / 1.7 $ / 1.6 $ / 1.43 $.

- Potential: Reduces up to -32 %.

Comment:

The bias remains neutral in Haussier if XRP is maintained over its support. Other economic publications, especially those followed by FomC meetings, could mean a decisive direction point and make the verification of this scenario.

XRP is currently developing in the consolidation phase after strong progression with dynamics that shows signs of breath. The market remains to wait -a -see, in a generally neutral technical context. The trend will now depend on the reaction of investors to other key price zones, with a fragile balance between the sale of pressure and the potential of recovery. In this context, it will be necessary to carefully monitor the strategic price response to confirm or modify the current forecasts.

Finally, remember that these analyzes are only based on technical criteria and that cryptocurrencies can develop rapidly according to other basic factors.

Are you interested in this study? Find our latest bitcoin analysis.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

Elyfe specialist in technical analysis decrypts graphic trends on the markets of cryptocurrencies with strict and constantly evolving approach. Through its detailed analyzes, it brings an enlightened view of prices dynamics, helps investors and enthusiasts better understand and predict market movements.

The provisions of unwavering:

The content and products listed on this page are in no way approved by Cointtribunian and should not be interpreted as responsibility.

Cointribune seeks to communicate all available information to the readers, but cannot guarantee its accuracy and exhaustion. We invite the reader to find out before any event concerning the company and also take full responsibility for their decision. This article cannot be considered as investment advice, offer or invitation to purchase all products or services.

Investments in digital financial assets include risks.

Read more