Retirement Planning: Planning for retirement is one of the most important steps you can take for a peaceful and secure future. Whether you are in your 30s, 40s, or 50s, it’s never too early or too late to start. In this simple guide, we’ll talk about how much money you might need for retirement and where you can invest wisely to build that fund.

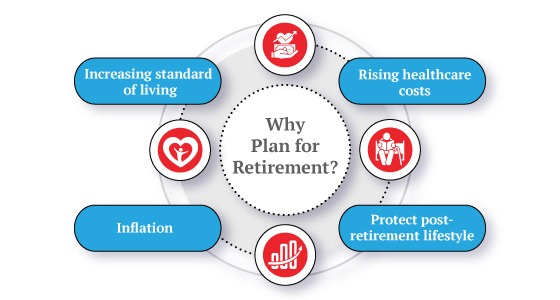

Why Retirement Planning is Important?

After retirement, your regular income stops, but your expenses continue. You still need money for food, bills, medicines, travel, and emergencies. If you don’t plan in time, you may depend on others or face financial stress. Retirement planning helps you stay independent and live a happy life after your working years.

How Much Fund You Need for Retirement?

There is no one-size-fits-all answer. It depends on your lifestyle, health condition, family needs, and inflation. But here’s a simple way to estimate:

Rule of Thumb:

You need around 25 times your yearly expenses at the time of retirement.

For example:

- If your current monthly expenses = ₹30,000

- Then yearly = ₹3,60,000

- So, required retirement fund = ₹3,60,000 × 25 = ₹90 lakhs

This is a rough estimate and will vary for each person.

Where to Invest Smartly?

To reach your retirement fund goal, you need to invest your money in the right places. Saving in a bank is safe, but the returns are low. Instead, a smart investment mix gives better results. Let’s look at different options:

1. Employees’ Provident Fund (EPF)

- Suitable for salaried people

- Employer and employee both contribute

- Offers tax benefits

- Safe and gives steady returns around 8%

2. Public Provident Fund (PPF)

- Government-backed scheme

- Lock-in period of 15 years

- Interest is tax-free

- Safe and suitable for long-term savings

3. National Pension System (NPS)

- Designed for retirement

- Offers equity + debt exposure

- Partial withdrawal allowed after 60

- Tax benefits under Section 80CCD

- Can give better returns than PPF or EPF in the long term

4. Mutual Funds (SIP)

- Start small with Systematic Investment Plan

- Ideal for young investors with time on their side

- Equity funds give higher returns but carry risk

- Debt funds are safer with moderate returns

- Best for wealth creation over 10–20 years

5. Fixed Deposits (FDs) & Senior Citizen Savings Scheme (SCSS)

- Best for retired or near-retirement age

- Low risk

- FD returns range from 6% to 7.5%

- SCSS is government-backed and offers higher interest than regular FDs

6. Real Estate & Gold

- Useful for asset creation

- Not ideal for regular income

- Gold can be a hedge against inflation

- Real estate gives rental income but has maintenance costs

Sample Investment Plan (For 30-Year-Old)

| Investment Type | Monthly Investment | Return % | Tenure | Purpose |

| Equity Mutual Fund SIP | ₹5,000 | 12% | 30 yrs | Wealth Growth |

| NPS | ₹3,000 | 10% | 30 yrs | Retirement Income |

| PPF | ₹2,000 | 7.1% | 15 yrs | Safe Savings |

| EPF (if salaried) | ₹5,000 | 8% | Till retirement | Fixed Income |

Tips for Smart Retirement Planning

- Start Early – The earlier you begin, the more you save with compounding.

- Review Regularly – Check your investments every 6–12 months.

- Diversify – Don’t put all your money in one place.

- Avoid High-Risk Bets – Don’t gamble with your retirement fund.

- Keep Emergency Fund – Always have at least 6 months’ expenses saved separately.

Final Thoughts

Retirement is not the end it’s the beginning of a new life chapter. With the right planning and smart investments, you can enjoy this phase without worries. Don’t wait for the “right time” today with what you can. Even small steps taken now can lead to a big, stress-free future.