Bitcoin retains his breath. In the context, where every economic decision can wave markets, it seems that the most sought -after digital asset is ready to take a new course. Among contradictory signals and febrile expectations, there is one thing certain: Here are 5 key factors that will make this week anything other than ordinary.

In short

- Bitcoin keeps the course at $ 93,500, a critical level for maintaining its upper dynamics up.

- Fed interest rates decisions could be strongly influenced by market management.

- The recession of the recession feeds on the demand for bitcoins as the value of refugees.

- Bitcoin’s dominance reached 65 %, signaling the pressure on altcoins before the possible “Alteason”.

- Return Fomo to social networks could cause impulsive purchases and increased volatility.

Bitcoin: What do investors need to know this week

This week, all eyes are turned to several key factors that could either cause bitcoin correction, or, on the contrary, to strengthen its upward dynamics since the beginning of April.

The threshold of $ 93,500 becomes strategic

Despite the temporary download at $ 93,350, bitcoins show strong resistance around its annual opening level. Recent data suggest that an important clump of liquidity sells for $ 96,420, which could play a magnetic role if the ascending trend is confirmed. Technical analysts like Crypnuvo evoke short -term optimistic scenarios, with targets of $ 97,000 or even $ 98,000 for BTC.

In order to verify this movement, BTC must necessarily maintain a threshold of $ 93,500. The loss of this key support would not invalidate recent rebounds and reopen the road to repair at $ 91,500. The battle is therefore played around the main psychological threshold.

Fed in the middle of the game

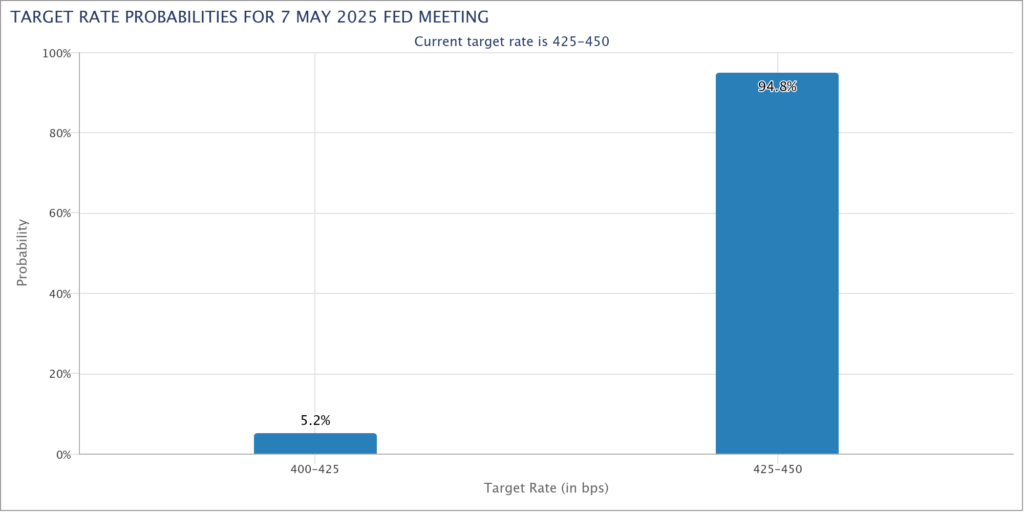

May 7. The Fed’s decision on interest rates could become the main catalyst. Although the likelihood of a decline is considered low (5.2 % according to CME Fedwatch), comments Jerome Powell are explored. Political pressure, embodied by Donald Trump, intensifies the bending of the central bank, but the persistent inflation limits its space for maneuvering.

Historically, they have risky active ingredients such as Bitcoin, tending to retreat from FOMC announcement. Therefore, a language that is considered too restrictive could cause a new wave of sales, while a more accommodating tone would revive the taste of buyers. The alerts are therefore introduced until the Powell press conference.

Fear of recession drives a bitcoins bet

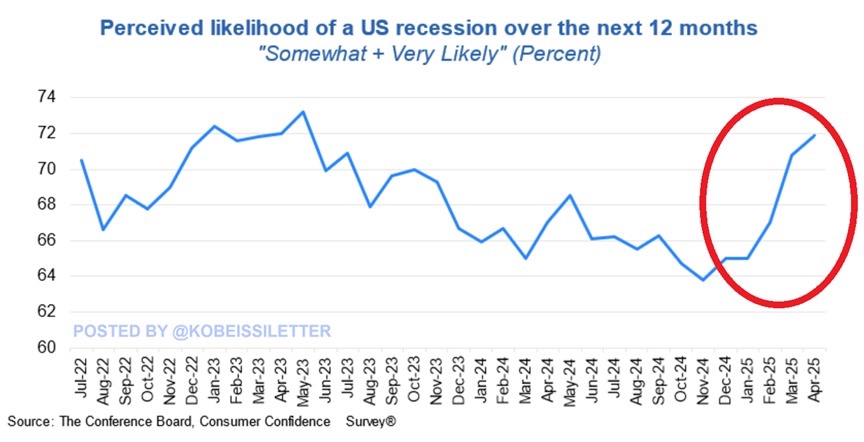

The US economy gives disturbing signs of slowing. The level of expectation of recession is 72 %, in the highest in two years. The context of trade wars with China and bad characters nourishes this anxiety climate for us. In this uncertain environment, Bitcoin attracts appearance as an alternative refuge.

Since the announcement of the new Customs Systems 2. April increased by 15 %. Institutional investors could highlight this dynamics in the case of new symptoms of stagflation. Result: Any negative macroeconomic data this week – especially employment data on 8 May – could paradoxically support BTC.

Bitcoin’s dominance will reach a critical threshold

The dominance of bitcoins on the market of the market is almost 65 %, never reached by the level since 2021. This dazzling climb reflects the mistrust of investors towards altcoins. According to the rectic capital, the last peak around 71 % could mark the end of the Haussier cycle for BTC and run “A” altseason Long.

This time, however, dynamics is different. Massive purchases of Blackrock or Michael Saylor via ETF Spot will change the situation. They store their BTC and do not translate them on altcoins that distort historical monuments. This unique configuration could further move the arrival of the real bull market on other cryptocurrencies.

Return Fomo could disrupt the market

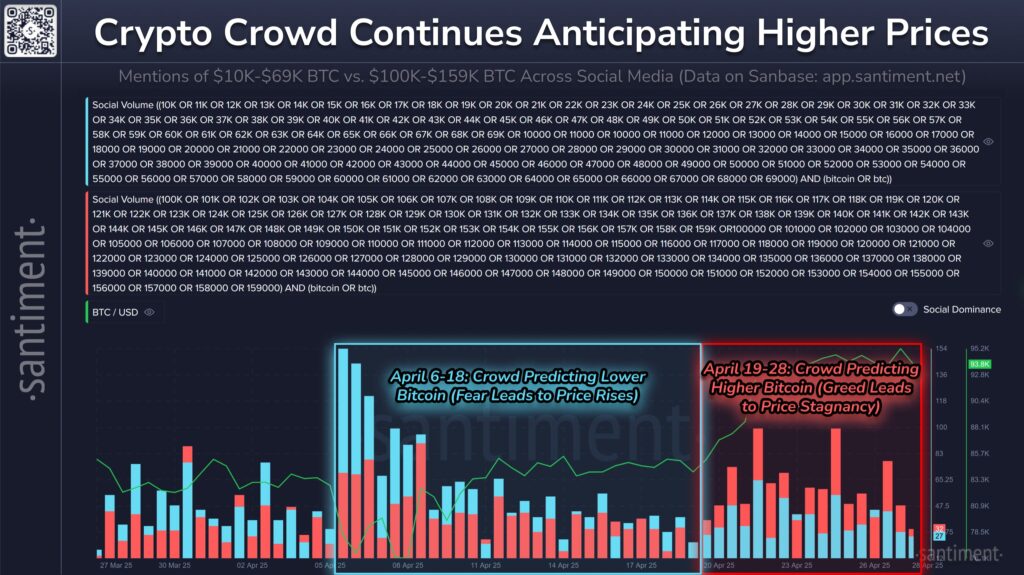

The feeling of investors turns into euphoria again. The fear and greed index stagnates in a neutral zone, but social networks show a clear increase in expectations of prices over $ 100,000. According to Santiment, the best time was to buy between 6 and 18 April, during which the pessimistic forecasts dominated.

At present, there is a risk that excess optimism is pushing late items on the market, threatening the stability of the price. Phenomenon ” Fomo This could lead to brutal fluctuations, especially in the absence of a concrete catalyst. Investors must therefore remain clearer and be careful about collective excitement.

What behavior to accept this week?

With regard to everything that has just been said, investors must be tactical vigilance this week. The $ 93,500 level serves as a barometer: if it holds, the short -term upper prospects remain credible, especially in the case of a favorable response to FOMC. However, volatility can revive the too aggressive Fed or macroeconomic surprise.

The most famous will be decided to progressive records between $ 91,500 and $ 92,500, in case of repair. Finally, FOMO increase requires strict risk management. Better to skip the train before getting into the car running at full speed without brake.

Bitcoin therefore develops at the intersection in May. Between economic pressures, political tension and excitement on the market, BTC hesitates between reflection and fall. This week could mean a decisive point of turnover, both for traders and for long -term investors. Better to be ready than surprised.

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.